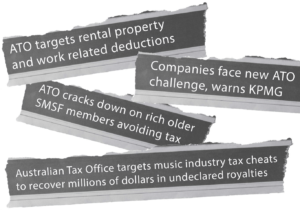

The Australian Taxation Office and other government bodies are scrupulously pursuing taxpayers.

The Australian Taxation Office and other government bodies are scrupulously pursuing taxpayers.

The media is keeping abreast of the increased audit activity that has been incurred as a result. Despite honest and thorough declarations, taxpayers can still be targeted for an audit, enquiry, investigation or review by the ATO. The costs incurred can be significant, even if the lodgements are correct, and no further adjustments are made.

The following are historical ATO focal areas: Data matching: The ATO typically has more than 640 million transactions reported to them annually. The ATO aimed to contact in excess of 450,000 taxpayers for data matching concerns. Cash economy: Annually there are approximately 245,000 pursuits around the cash economy. GST refunds: More than 43,000 GST and other indirect tax refund integrity checks, audits or reviews were conducted by the ATO. Excess Contributions Tax: 84,200 assessments and compliance checks were estimated to be made within a financial year with regard to the Superannuation Excess Contributions tax. Benchmarking: A review of the historic benchmarking activity conducted by the ATO found that over 75% of the cases involved were found to be compliant or of low risk.

This article appeared in our September 2016 newsletter.