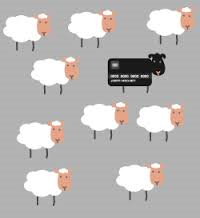

From 1 July 2017, the Government is enhancing the integrity of the tax system by allowing the ATO to disclose to credit reporting bureaus the tax debt information of businesses who have not effectively engaged with the ATO to manage these debts. Businesses that do not pay their tax, gain an unfair competitive and financial advantage over those that do.

From 1 July 2017, the Government is enhancing the integrity of the tax system by allowing the ATO to disclose to credit reporting bureaus the tax debt information of businesses who have not effectively engaged with the ATO to manage these debts. Businesses that do not pay their tax, gain an unfair competitive and financial advantage over those that do.

This applies to tax debts more than $10,000 and 90 days overdue.

This article appeared in our April 2017 newsletter